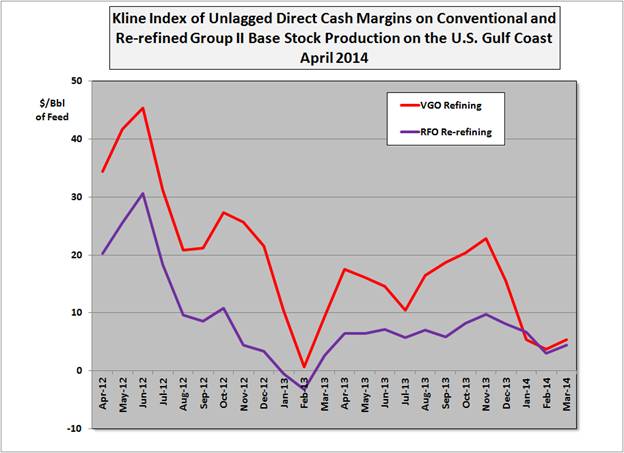

In January, Parsippany, NJ-based consulting and research firm Kline & Company introduced its monthly Base Stock Margin Index, a characterization of recent cash margin contributions in the U.S. base oil market over the past 24 months.

The Index estimates cash margin contributions associated with U.S. Group II base stock production. It simulates EBITDA before the deduction of corporate SG&A expenses for typical VGO-based virgin base stock plants and RFO-based re-refineries. A more detailed description of the Margin Index can be found in the January release.

“Margins for Group II base oil refineries and re-refineries rebounded for the month of March, as profit improvements were derived from Group II price increases, accompanied by declines in feedstocks and consumables costs,” said Ian Moncrieff, who manages Kline’s price forecasting activities. “During March, we saw most base oil producers introduce posting increases of around 2.5% for low viscosity grades (— $4/Bbl) and 5% for higher viscosity grades (— $8/Bbl), together with selective reductions in TVAs. Improved market conditions, allied with cost pressures, contributed to the upward base oil posting adjustments. On the cost side, LSVGO prices dropped by nearly $4/Bbl during March and greatly helped the profitability of virgin base oil refiners.” Kline expects that the margin improvements registered in March will continue into April as the full effects of the recent round of upward base oil price increases are felt and fundamentals remain tight. However, the impending impact of Chevron’s Pascagoula plant start-up in May/June continues to cast a cloud over the ability of producers to raise margins to pre-2013 levels in the medium term.